20 Top Suggestions To Choosing AI Stock Investing Platform Sites

20 Top Suggestions To Choosing AI Stock Investing Platform Sites

Blog Article

Top 10 Tips For Evaluating The Accuracy And Performance Of Ai Stock Prediction/Analyzing Platforms For Trading

To ensure that you are making use of a platform that is capable of providing accurate and reliable forecasts and insights it is essential to test the accuracy and effectiveness of AI stock-predicting and analysis platforms. Here are 10 top suggestions to help you analyze these platforms.

1. Backtesting Results

What to look out for: Determine if the platform offers backtesting to determine how well its predictions would've performed using previous data.

Why it is Important When comparison of the AI model's predictions to actual historical outcomes, backtesting validates its accuracy.

Tip: Look for platforms that let you customize backtesting parameters (e.g., time frames and assets classes).

2. Real-time Performance Monitoring

What to Watch Out For: How the platform performs during real-time conditions.

Why it's Important The real-time results are a better indication of the efficiency of a platform rather than past backtesting.

Tip : You can sign up for an account demo, or an evaluation version of the software to track the real-time movement and then compare it with your predictions.

3. Prediction Error Metrics

What to Look For Measurements such as Mean Absolute Error and Root Mean Squared Error or R-squared in order to measure the accuracy of your predictions.

Why It's Important: These measures provide a quantifiable measure of the degree to which predictions match the actual outcomes.

Tip : Platforms with openly shared metrics are usually more transparent.

4. The rate of winning and the success ratio

What to Check the platform's win rate (percentage of correct predictions) and the success rate (profitability on the basis of the predictions).

Why it matters The high rate of win and success ratio indicates better forecasting accuracy and potential profits.

Remember that no system is 100% perfect.

5. Benchmarking against market Indicators

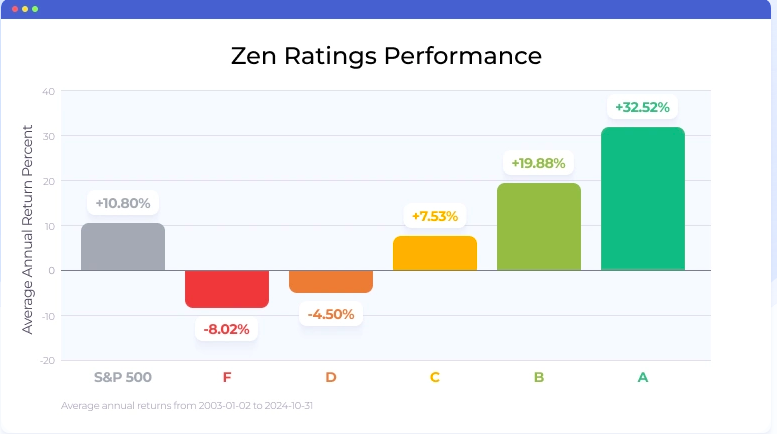

What to Look For What to Look For: Compare the platform's forecasts and performance to the major market indexes (e.g., S&P 500, NASDAQ).

What it does It can help determine if the platform performs better or more than the overall market.

Find consistency in performance, not only gains over a short period of time.

6. Consistency across Market Conditions

What to look for What to look for: Find out how the platform's performance is affected by various market conditions (bull or bear markets, high volatility).

What is important A reliable platform should be able to perform in a variety of conditions, not just in favorable conditions.

Try the platform's predictions in turbulent markets or during market declines.

7. Transparency in Methodology

What to look out for How to recognize AI algorithms and models (e.g. reinforcement learning or neural networks, reinforcement learning, etc.).

Why It's Important: Transparency allows you to assess the scientific and technical rigor of a platform.

TIP: Beware of platforms that use "black box" models without describing how they generate predictions.

8. User Reviews and Independent Testing

What to Look For What to Look For: Read reviews from users and search for independent testing or third-party evaluations of the platform.

Why is it Important Reviews and tests conducted by independent experts offer unbiased information about the platform's accuracy.

Read user reviews on forums like Reddit copyright and financial blogs.

9. Risk-Adjusted Returns

What to Look For What to Look For: Assess the performance of your platform using risks-adjusted indicators such as the Sharpe Ratio or Sortino Ratio.

Why it is Important The metrics are used to measure the level of risk taken to achieve returns, providing a more comprehensive view of performance.

Sharpe ratios (e.g. over 1) suggest a higher risk-adjusted rate.

10. Long-Term Track Record

What to look out for: Examine the effectiveness of the platform over a long period (e.g. over a period of 3-5 years).

What is important. Long-term performance can be an excellent indicator of reliability than short term results.

Beware of platforms that only display some short-term results or only show a few instances of success.

Bonus Tip - Test your account by using the demo version

Check out the platform's real-time prediction by using a demo or trial account, without having to risk your real money. This lets you evaluate the accuracy and effectiveness of the system firsthand.

The following tips can assist you evaluate the reliability and performance AI platforms for stock prediction. This will enable you to select a platform that best suits your trading needs and risk tolerance. Don't forget that no platform will be perfect. Combining AI knowledge with your studies is the most effective way to go. Have a look at the recommended inciteai.com AI stock app for website recommendations including ai for stock trading, ai investing, ai stocks, ai stock, ai stock market, ai for stock trading, ai investment app, investment ai, stock ai, ai stock picker and more.

Top 10 Tips To Evaluate The Scalability Of Ai Platform For Analyzing And Predicting Trading Stocks

Scalability is a key factor in determining whether AI-driven platforms for stock forecasting and trading can handle growing demand from users, increasing volume of data and market complexity. These are the top 10 suggestions to evaluate the scalability of AI-driven stock prediction and trading platforms.

1. Evaluate Data Handling Capacity

Find out if your platform can analyze and process large datasets.

The reason: Scalable systems need to manage data volumes that are growing without performance degradation.

2. Test the Real-Time Processing Capabilities of your processor

See if your platform handles live streams of data in real-time including live stock quotes, or breaking news.

The reason: The immediate analysis of trading decisions is vital because delays could lead you to miss opportunities.

3. Cloud Infrastructure Elasticity and Check

TIP: Check if the platform uses cloud-based infrastructure (e.g., AWS, Google Cloud, Azure) and can scale resources dynamically.

Cloud platforms are able to allow for elasticity. The system can be scaled up or down depending on the demands.

4. Assess Algorithm Efficiency

Tip 1: Examine the computational efficiency for the AI models that are being utilized (e.g. reinforcement learning deep learning, reinforcement learning, etc.).

Reason: Complex algorithmic structures can consume a lot of resources. Optimizing them is essential to scale them.

5. Study parallel processing and distributed computing

Tip: Check if the platform leverages parallel processing or distributed computing frameworks (e.g., Apache Spark, Hadoop).

Why: These new technologies offer faster data analysis and processing on multiple nodes.

Examine API Integration, and Interoperability

TIP: Examine the integration of the platform to external APIs.

Why: Seamless platform integration makes sure it is able to adapt to any new sources of data or trading environments.

7. Analyze User Load Handling

To check the performance of your system, simulate high traffic.

Why: A scalable platform must be able to maintain its performance as the number of users increases.

8. Examine the model's retraining capabilities and adjustability

Tip: Determine how frequently and efficiently the AI models are trained using new data.

The reason is that models must continuously change to keep up with the ever-changing market to stay accurate.

9. Verify Fault Tolerance and Redundancy

Tips: Make sure that the platform has failover mechanisms, and has redundancy in case of software or hardware malfunctions.

Reason Trading is expensive, so scaling and fault tolerance are essential.

10. Monitor Cost Efficiency

Examine the cost of your platform that includes cloud resources, storage and computing power.

What is the reason: The expense of scalability should not be unsustainable. Thus, it's important to balance performance with expense.

Bonus Tip Future-Proofing

Check that the platform has been constructed to integrate new technologies (e.g. quantum computing, quantum computing, advanced NLP) and to adapt to regulatory changes.

These elements will help you evaluate the scaleability of AI-powered stock prediction systems and trade platforms. They'll also make sure that they are robust, efficient and ready to expand, and future-proof. Have a look at the top rated best stock prediction website for more info including ai stock price prediction, best ai stocks, ai stock trader, how to use ai for copyright trading, ai share trading, best stock prediction website, chart analysis ai, free ai tool for stock market india, best ai penny stocks, invest ai and more.